Digital wallets are becoming increasingly relevant in today's fast-paced world, where convenience and security are paramount. Understanding how they work can empower you to offer better services to your customers, improve operational efficiency, and even open up new revenue streams. This guide aims to demystify digital wallets by breaking down complex concepts into simple terms, enabling you to leverage this technology effectively. Whether you're just starting out or looking to optimise your current payment systems, this guide will serve as a valuable resource.

What are digital wallets?

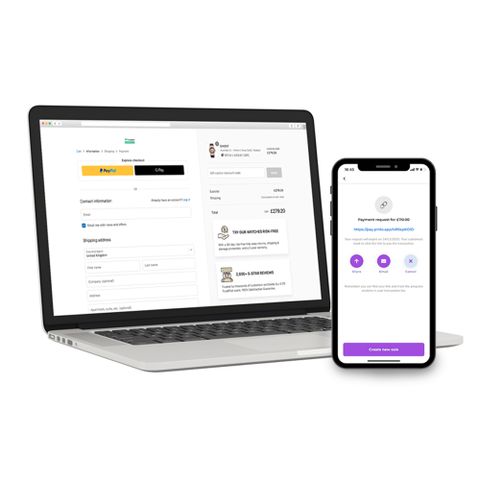

Let's start with the basics. A digital wallet, often referred to as an e-wallet, is a software-based system that securely stores users' payment information and passwords for numerous payment methods and websites. Think of it as a virtual wallet that lives on your smartphone or computer, allowing you to make transactions without the need for physical cards or cash. This modern solution streamlines the payment process, offering a level of convenience and security that traditional methods can't match.

Digital wallets use advanced encryption technologies to protect sensitive information, making them a safer alternative to carrying physical cards. They also enable users to manage multiple payment methods in one place, simplifying the checkout process both online and in-store. As more consumers and businesses adopt digital wallets, understanding their functionalities and benefits becomes crucial for staying competitive in the market.

The different types of digital wallets

Digital wallets come in various forms, each offering unique features and benefits. Here's a look at some popular types:

Mobile money

Mobile money allows users to store, send, and receive money using their mobile phones. It's a popular option in regions where traditional banking services are limited. With mobile money, you can pay bills, transfer funds, and even purchase goods and services directly from your phone. This form of digital wallet has revolutionized financial access in developing countries, enabling millions to participate in the digital economy.

In addition to enhancing financial inclusion, mobile money services often integrate with local economies, supporting small businesses and entrepreneurs. They also offer unique features, such as microloans and savings plans, that cater to the needs of underserved communities. As mobile penetration continues to rise, mobile money is expected to play an increasingly vital role in global finance.

Cryptocurrency wallets

Cryptocurrency wallets are designed to store and manage digital currencies like Bitcoin and Ethereum. These wallets can be hot (online) or cold (offline), with each type offering different levels of security and convenience. Hot wallets are typically more accessible for frequent transactions, while cold wallets offer enhanced security for long-term storage.

The rise of blockchain technology and cryptocurrencies has spurred innovations in digital wallet design, creating opportunities and challenges for users. As more people invest in cryptocurrencies, understanding the nuances of these wallets becomes crucial for secure and efficient asset management. With regulatory environments evolving, cryptocurrency wallets are likely to become more integrated into mainstream financial systems.

Payment apps

Payment apps like PayPal, Venmo, and Square Cash are widely used for peer-to-peer payments and business transactions. These apps often integrate with your bank account or credit card, making them a versatile option for digital payments. They offer features such as instant transfers, payment tracking, and transaction history, adding convenience to both personal and professional financial management.

The popularity of payment apps is driven by their ease of use and wide acceptance across various merchants and platforms. They often include social features that enhance user engagement, such as splitting bills or sending money as gifts. As digital payment solutions continue to evolve, payment apps are likely to incorporate even more innovative features to maintain their competitive edge.

NFC-Enabled wallets

Near Field Communication (NFC) technology allows devices to communicate when they're close to each other. NFC-enabled wallets, like Apple Pay and Google Pay, let you make contactless payments by simply tapping your phone on a compatible terminal. This technology offers a fast and secure payment method that enhances the shopping experience by reducing wait times at the checkout.

As consumer demand for contactless payment options grows, businesses that adopt NFC-enabled solutions can enjoy increased customer satisfaction and loyalty. This technology also supports seamless integration with loyalty programs and digital receipts, offering additional value to users. With the ongoing advancement of NFC technology, we can expect even more sophisticated applications in the near future.

Why digital wallets are important for businesses?

Digital wallets offer numerous advantages for businesses, particularly small businesses and startups. Here are a few reasons why you might consider integrating digital wallet solutions into your operations:

Enhanced convenience

Digital wallets streamline the payment process, making it quicker and easier for customers to complete transactions. By offering a variety of payment options, you can cater to diverse customer preferences and enhance the overall shopping experience. This not only improves customer satisfaction but can also lead to increased sales and repeat business.

In today's competitive market, providing a seamless checkout experience can be a significant differentiator. Digital wallets enable businesses to offer quicker transaction times and reduce the friction often associated with traditional payment methods. By embracing this technology, you can position your business as forward-thinking and customer-centric.

Improved security

With digital wallet security features such as encryption and tokenization, transactions are more secure than traditional payment methods. This reduces the risk of fraud and chargebacks, protecting both your business and your customers. By minimizing these risks, you can build trust with your clientele, which is essential for long-term success.

The advanced security measures employed by digital wallets also help businesses comply with data protection regulations, reducing the risk of costly breaches and penalties. As cyber threats continue to evolve, staying ahead of security trends can safeguard your reputation and provide peace of mind to your customers.

Cost-effective payment processing

Digital wallets often come with lower transaction fees compared to credit card payments. By reducing payment processing costs, you can improve your bottom line and reinvest savings into growing your business. This can be especially beneficial for small businesses and startups operating on tight margins.

Lower transaction fees aren't the only financial benefit of digital wallets. They can also speed up cash flow, as transactions are processed more quickly than traditional methods. This efficiency can be crucial for businesses looking to maintain healthy cash reserves and invest in new opportunities.

The future of digital wallets

The digital wallet landscape is continually evolving, driven by advances in technology and changing consumer preferences. Here's a glimpse of what the future might hold:

Increased adoption of contactless payments

As more consumers embrace the convenience of contactless payments, businesses must adapt by integrating NFC-enabled wallets and other contactless payment solutions into their systems. This shift is expected to accelerate as technology becomes more widespread and consumer demand for fast, secure payment options grows.

With the ongoing global pandemic highlighting the need for touchless solutions, contactless payments have become more relevant than ever. Businesses that adopt these technologies can enhance customer safety and satisfaction, positioning themselves as leaders in the digital economy.

Expansion of cryptocurrency payments

As cryptocurrencies gain popularity, more businesses are likely to accept digital currencies as a form of payment. This trend may lead to the development of new cryptocurrency wallets and payment processing solutions tailored to business needs. Embracing cryptocurrency payments can open up new markets and customer segments, offering a competitive edge.

The increasing mainstream acceptance of cryptocurrencies may also drive regulatory changes, making it easier for businesses to incorporate digital currencies into their payment systems. Staying informed about these developments can help businesses strategically integrate cryptocurrency payments into their operations.

Enhanced integration with IoT devices

The Internet of Things (IoT) is transforming the way we live and work, and digital wallets are no exception. In the future, we might see digital wallets integrated with IoT devices, enabling seamless transactions across various platforms and environments. This could revolutionize industries such as retail, hospitality, and transportation, offering unprecedented convenience.

As IoT devices become more prevalent, the potential for digital wallets to facilitate automated, context-aware transactions will grow. Businesses that leverage these technologies can offer innovative services that enhance customer experiences and streamline operations, setting themselves apart in a crowded market.

Stay ahead of trends with digital wallets

Incorporating digital wallets into your business operations can offer numerous benefits, from enhanced convenience to improved security. By understanding the different types of digital wallets and selecting the right solution for your needs, you can provide a seamless, modern payment experience for your customers. Embrace the future of digital payments and watch your business thrive in this ever-evolving landscape. As technology continues to advance, staying ahead of trends will ensure your business remains competitive and relevant, catering to the evolving preferences of your customers.