The Rise of Online Payment Gateways

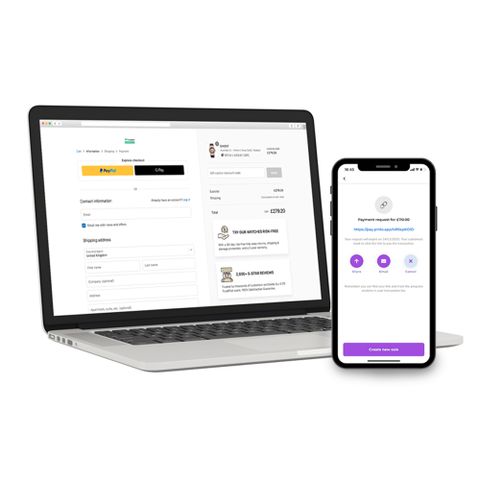

Online payment gateways have become vital in an ever growing digital world and have expanded alongside the booming e-commerce sector. Gateways provide businesses a secure, efficient way to conduct transactions globally.

These platforms enhance user experience by offering multiple payment options with consumers appreciating the convenience and security. Whilst businesses benefit from easy integration and low transaction costs.

With the continued rise in online shopping, payment gateways will continue to grow in importance. They are crucial in meeting the demands of digital consumers and their role in the economy is becoming more significant as we move further into a digital-first world.

The Surge in Card and Mobile Payments

Card and mobile payments have surged, capturing consumer interest worldwide. These methods offer speed and flexibility, fitting seamlessly into busy lifestyles. Their convenience enhances user satisfaction, encouraging more frequent transactions.

Mobile payments allow users to manage finances on the go. Meanwhile, card payments remain a staple due to their wide acceptance. Together, they cater to diverse consumer preferences, reshaping the payment landscape. As technology advances, we expect these payment methods to become even more integrated into everyday life, transforming how we make purchases.

The Contactless Revolution: A Touch-Free Future

Contactless payments have gained massive popularity due to their speed and convenience. Consumers appreciate the ability to make transactions by simply tapping their cards or phones. This shift to touch-free payments aligns well with a growing desire for hygiene and efficiency.

In recent years, the expansion of NFC (Near Field Communication) technology has fueled this trend. More businesses are adopting NFC-enabled systems to enhance customer experience. As we move towards a cashless society, contactless payments will likely become the standard. This transition presents both opportunities and challenges for businesses worldwide, requiring careful adaptation and strategic planning.

Digital Wallets: Convenience at Your Fingertips

Digital wallets have revolutionised how consumers manage their finances, their convenience allows users to store card information securely and make payments quickly. With just a few taps, transactions can be completed without needing a physical wallet.

As smartphone adoption rises, so does the use of digital wallets. Integration with apps and online platforms enhances user experiences, making purchases seamless. This technology promotes a cashless environment, aligning with modern consumer preferences. As digital wallets continue to evolve, they offer businesses the chance to attract tech-savvy customers and streamline their payment processes.

Enhancing Security in Payment Transactions

Security is a top priority in the world of payments. As digital transactions rise, so do security risks. Businesses must ensure consumers’ data is protected to gain and keep trust.

Advanced security measures, like biometric authentication, offer enhanced protection, by using fingerprints or facial recognition, payments become both secure and convenient. These methods help reduce fraud risks and boost consumer confidence. Payment providers continuously innovate to stay ahead of threats, maintaining safe digital environments for users. As a result, consumers can shop with peace of mind, knowing their information is secure.

Fintech Innovations Leading the Charge

Fintech innovations are transforming the payment industry rapidly. These advancements streamline transactions, making them faster and more efficient. Cutting-edge technologies are crafting seamless experiences for businesses and consumers alike.

Artificial intelligence and blockchain have significant roles in reshaping payments. AI enhances fraud prevention, automating the detection of suspicious activities. Meanwhile, blockchain increases transparency and security, reducing transaction costs. As these technologies evolve, they present new opportunities and challenges for the industry. Fintech's dynamic nature continues to push boundaries, ensuring continual progress in payment solutions. This ongoing evolution promises even more exciting changes ahead in the payment landscape.

Cryptocurrency Payments: The New Frontier

Cryptocurrency payments are gaining traction, offering decentralised alternatives to traditional finance. As digital currencies like Bitcoin and Ethereum become mainstream, they challenge existing payment methods. Businesses and consumers are exploring this new frontier for its potential benefits.

The appeal of cryptocurrencies lies in their ability to facilitate cross-border transactions. They enable payments without intermediaries, which reduces fees and processing times. Despite regulatory hurdles and volatility, their adoption is on the rise. As more entities accept digital currencies, cryptocurrency payments might redefine financial interactions. This shift could lead to profound changes in how we perceive money and transactions in the future.

Real-Time Payments: Speed is of the Essence

Real-time payments have become crucial in the fast-paced digital world. These systems allow money to move almost instantly. As expectations for speedy transactions grow, businesses and consumers increasingly prefer real-time payment options.

These systems offer significant advantages beyond speed. They facilitate better cash management and improve liquidity for businesses. Furthermore, real-time payments enhance the customer experience by ensuring immediate access to funds. This immediacy aligns perfectly with today's on-demand economy, where fast service is a competitive edge. Real-time payments are set to become a standard, driving efficiency and satisfaction in financial transactions.

Regulatory Changes and Their Impact on the Industry

Regulatory changes play a critical role in shaping the payment industry. Laws and regulations like PSD2 and GDPR in Europe set new standards for data protection and consumer rights. These regulations aim to bolster security and enhance transparency in financial transactions.

However, compliance with new laws presents challenges for businesses. Adapting to evolving regulations requires significant investment in technology and processes. Despite the hurdles, regulatory changes can foster innovation. They encourage the development of new payment solutions that prioritise security and consumer trust. In the long run, these regulations aim to create a fairer, more secure payment landscape for everyone.

Conclusion: The Future of Payments

The future of payments promises excitement and innovation. As technology evolves, payment systems will become faster and more secure. Businesses and consumers alike will benefit from increased convenience and choice. Staying ahead of trends and embracing change will be key to thriving in this dynamic landscape.