The Rise of Card Payments

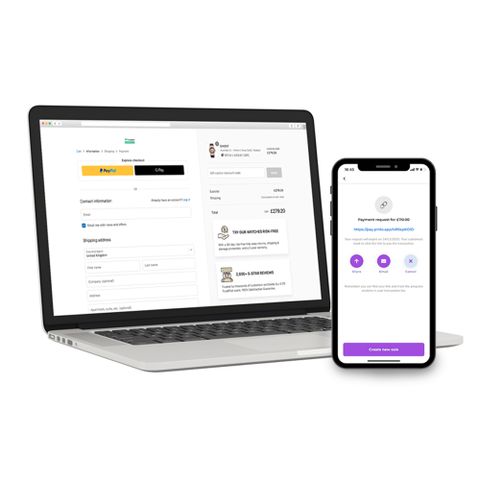

The shift towards card payments has been driven by a combination of technological advancement and changing consumer preferences. With the advent of sophisticated payment systems like our smart mobile card machines, businesses are equipped with tools that streamline operations and enhance customer experience. These systems offer not only the ability to process transactions swiftly but also provide valuable insights into consumer behaviour.

Benefits for Retailers

Retailers across the board are reaping the benefits of adopting card payment systems. One significant advantage is increased sales. Consumers tend to spend more when using cards compared to cash, partly because cards reduce the psychological pain of spending. Furthermore, card payments facilitate faster checkouts, reducing queues and improving customer satisfaction.

Systems like our online payments platform also offer robust security features, protecting both the retailer and the consumer from fraud. This increased security builds trust with customers, encouraging repeat business and fostering customer loyalty.

Case Study: Sainsbury's Card Payments

A compelling example of card payments revolutionising retail can be seen with Sainsbury's, one of the UK's leading supermarket chains. Sainsbury's card payments system has been instrumental in enhancing their customer service. By integrating advanced payment solutions, they have managed to reduce transaction times significantly and improve overall store efficiency.

The data collected from card transactions at Sainsbury's also allows for better inventory management and targeted marketing strategies. These insights enable the chain to tailor its offerings to meet customer demands more precisely, leading to increased sales and customer satisfaction.

Read the full case study here

Future of Card Payments in Retail

As technology continues to evolve, the future of card payments in retail looks promising. Innovations such as contactless payments, mobile wallets, and biometric authentication are set to make transactions even more seamless. Retailers who embrace these advancements will not only meet consumer expectations but will also position themselves as leaders in a rapidly changing market landscape.

In conclusion, card payments are not just a trend but a transformative force in retail. By adopting these systems, businesses can enhance their operational efficiency, boost sales, and provide superior customer service. Retailers who understand and leverage this revolution will undoubtedly gain a competitive edge in the marketplace.